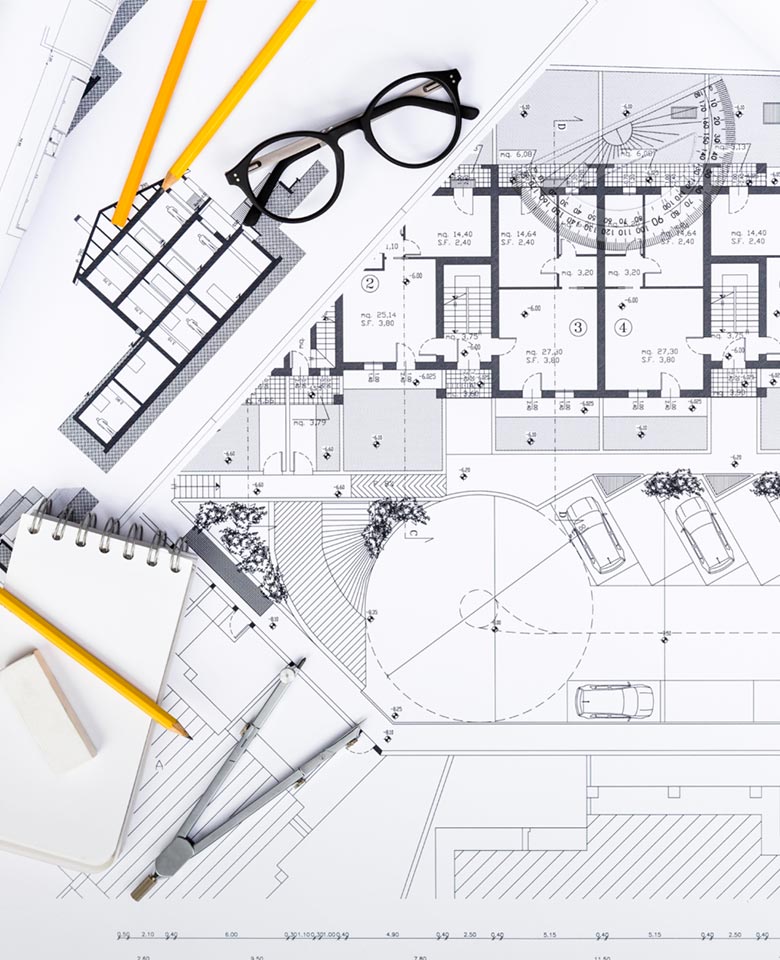

Empower Your DBE Contractors

Training | Coaching | Funding | Reporting

We help cities, states and federal entities prepare Small Business, Minority Owned Business and Disadvantaged Business Enterprises to fulfill government contracts by increasing financial capacity and empowering them to succeed.

Workshops & Education

Train contractors to understand their financial picture and what is necessary to complete the work on successful bids.

Business Consulting

Through 1 on 1 coaching we help contractors understand where they are at and their next steps toward capitalization

Capital Placement

We identify financial requirements to strengthen capacity and position each business for funding to a network of lenders.

ABF Consulting Group

We build capacity.

Get to know our five step process:

- Teach the financial requirements for financing

- Rank businesses based on readiness

- Develop plans of action for each business to progress

- Source capital

- Coach and Follow Up

Meet FinCap

Solutions Customized To Your Needs

Workshop Facilitation

Education

Consulting

Develop your ability to manage and track return on investment.

Capital Placement

Experienced Leaders

to support your company growth.

Small Businesses need a partner in the financial industry who can bring the best practices from banking and finance to help them grow. That’s exactly what ABF and our network of providers set out to do when we founded this organization. Our experience comes out of big banking and private lending as well as small business ownership. We’ve lived the process right along with our colleagues and partners in construction and government contracting sector.

As a DBE certified business, we’ve lived the process of building and developing capacity from the ground up. Something that is important to remember, the DBE status was not created to maintain small businesses, but to provide business owners from historically disadvantaged groups the knowledge, skill and ability to compete with the major players and to successfully bid, complete projects and grow.

With experience comes confidence. ABF has the experience to provide you and your business community the knowledge, skills, abilities and insights to take the next step in business development. Build skills, capacity and confidence with ABF. Come and meet the team!